1. Tariff concerning questions on imported motor vehicles of permanent personnel and settled foreigners.

Answer: According to national regulations, ports including Shanghai Port, Tianjin New Port, Dalian New Port and Guangzhou Huangpu Port are provided with import services of finished automobile. For detailed taxation information, please contact the customhouse of the handling port. In consideration of the accuracy, the tax rate decided on site shall prevail. In line with Circular the State Council Regarding the Amendments Of The Policy Of The Tariff And The Tariff Reduction And Exemption On Imported Small Motor Vehicles (GF [1993] No. 87), imported motor vehicles given as gifts by international organizations and foreign governments as well as those purchased by agencies and personnel that are entitled with deducted tariff subject to international treaties with China concluded and to agreements achieved by Chinese government and foreign governments; any imported motor vehicle purchased by agencies and personnel not applicable to the aforementioned circumstances shall be levied with import tariff, import linkage value-added tax and other taxes. Customs duty rate of motor vehicles is 25%, value-added tax rate is 17% and consumption tax rate is calculated according to gas displacement of motor vehicles (please refer to annual report of General Administration Customs of the People’s Republic of China: 2006 China Customs No. 15 ). 2. Formula: Levied customs duty of ad valorem: Tax Payable=Duty-paying value × customs duty rate; Formula of levied import linkage value-added tax: Tax Payable=(Duty-paying value + empirical customs duty + empirical consumption tax) × value-added tax rate; formula of levied import linkage consumption tax: tax payable= ??duty-paying value + empirical customs duty?/(1 – consumption tax rate) ?× consumption tax rate.

2. What are the taxation regulations of separating employees from embassies in foreign countries?

Answer: For returnees who have met the aforementioned conditions, one purchased motor vehicle entering China is free of import tariff; import linkage value-added tax and consumption tax are levied in accordance with regulations.

3. What are overseas students required to submit when purchasing duty-free motor vehicles back in China?

Answer: In accordance with Measures of General Administration of Customs of the People’s Republic of China for Administration of Duty-Free Domestic Motor Vehicles Purchased by Overseas Students Returning to China (Official Documents issued by General Administration of Customs: JE [1992] No. 1678), documents required to be submitted for vehicle purchase (original and copies): (1) valid passport of overseas student; (2) Proof of Returned Overseas Students issued by Chinese embassies from foreign countries; (3) Residence Certificate in China issued by Public Security Bureau (original ID card, Residence Register Booklet and their copies); (4) Outbound Graduate (Course-Completion) Certificate of overseas students or Invitation Letter from overseas universities, and certification documents issued by domestic educational departments; (5) Application Form for Import/Export of Personnel Effects; (6) other documents deemed to be necessary by administration of customs.

Legal Ground:

Notices for questions concerning About Duty-Free Motor Vehicle Purchase by Overseas Students Returning to China for Work (SJE [1993] No. 528);

Notices form General Administration of Customs for Simplifying and Regulating Formalities concerning Domestic Vehicle Purchase by Overseas Students (SJF [2004] No. 341)

Written Reply from General Administration of Customs for Time Period of Study of Overseas students Returning to China (JGH [2004] No. 176)

Measures of General Administration of Customs of the People’s Republic of China for Administration of Duty-Free Domestic Motor Vehicles Purchased by Overseas Students Returning to China (SJE [1992] 1678)

4. What are the conditions for overseas students to meet before can apply for duty-free domestic motor vehicle purchase?

Answer: Overseas students shall register in standard universities (colleges) abroad, have studied or had further education (including outbound further education and cooperative study) therein for no less than one academic year and stay abroad for no more than two years after graduation; meanwhile, the application for duty-free motor vehicle purchase shall be submitted within one year since the day they entered China; motor vehicles to be purchased shall be provide by automobile manufacturers instead of 4S stores.

5. Are returned overseas students entitled to applying for duty-free domestic motor vehicle in local Administration of Customs of workplace?

Answer: Yes, they can. Original copy and copies required: 1. valid passport of overseas student; 2. Proof of Returned Overseas Students issued by Chinese embassies from foreign countries; 3 Residence Certificate in China (Temporary Residential Permit and Working Certificate) issued by Public Security Bureau; 4 Outbound Graduate (Course-Completion) Certificate of overseas students or Invitation Letter from overseas universities; 5. Application Form for Import/Export of Personnel Effects;. Other documents deemed as necessary by administration of customs. The aforementioned information is for reference only; the final result from administrating customs shall prevail.

6. Is the Administration of Customs in charge of supervising taxed import motor vehicles which are purchased by non-citizens working in foreign-funded enterprises? Is it permitted to resell taxed import motor vehicles in China?

Answer: Taxed import motor vehicles of permanent personnel are subject to Customs supervisions within one year from the entry. Within one year from the entry and upon Customhouse’s approval, the above motor vehicle can be resold to personnel of the same qualification (permanent personnel with unused vehicle quota) after record concerning formalities are done; otherwise the reselling is not permitted. After one year the permanent personnel can apply to customhouse for the certificate supervision removal, indicating that the motor vehicle is no longer subject to supervision and could be resold.

7. Are duty-free motor vehicles purchased by overseas students resellable?

Answer: In accordance with relevant regulations and laws, “Purchased duty-free domestic motor vehicles are deems as duty-free imported vehicles which are subject to six years of supervision.; reselling and ownership are not permitted within two years from the day of goods delivery. Approval from customhouse must be gained and duty short-paid must be paid before duty-free vehicles are resold in the supervision period. ” However, the current status is that the Administration of Customs no longer exerts supervision over private cars and formalities could be handled according to individual situation. Nevertheless, taxation departments are required to be consulted for questions concerning duty short-paid in the case of vehicle reselling.

8. In the circumstance where foreign permanent personnel will purchase a motor vehicle for private use and he intends to resell the taxed import vehicle to Chinese resident after one year since the taxed import, what are the procedures?

Answer: In accordance with No. 30 Notice issued by the Administration of Customs in 2006, one year after the taxed import vehicle of permanent personnel is registered in departments of public security and administration, the reselling is permitted. Upon the approval of governing customhouse, People’s Republic of China Customs Control Vehicles Deregulation Certificate will be issued, with which the permanent personnel can go through reselling formalities in departments of public security and administration. Taxed import vehicles could be transferred to Chinese residents without extra taxes once the supervision is lifted. The aforementioned information is for reference only; the final result from administrating customs shall prevail.

9. What are the procedures of reselling taxed import vehicles for private use of permanent personnel?

Answer: In accordance with paragraph 3 of Article 3 of The Method, taxed import motor vehicles purchased by permanent personnel are subject to customs supervision and annual verification. A six- year follow-up supervision is exerted by governing customhouse since the customs release; the vehicles can be applied to be resold to others with the same qualification within six years. After the reselling is done, the buyer are not entitled to applying for another self-use imported vehicle purchase.

After six years, where the motor vehicle is transferred to personnel without the same qualification, the transferee shall pay for the duty short-paid to governing customhouse and take People’s Republic of China Customs Control Vehicles Deregulation Certificate to vehicle administration office for transfer formalities. The aforementioned information is for reference only; the final result from administrating customs shall prevail.

10. What are the procedures to deregulating customs control over duty-free motor vehicle for permanent personnel’s private use?

Answer: In accordance with Article 14 of No. 194 Notice issued by the General Administration of Customs, where the supervision period of motor vehicles expires, permanent personnel shall apply for deregulation in governing customhouse with Customs of the People’s Republic of China – Application Form For Lifting Control over Official and Personal Vehicles (claimed on site), valid identity document, document of long-term residence, Registration Certificate of Motor Vehicles Under Control and Vehicle License. Upon approval of governing customhouse, People’s Republic of China Customs Control Vehicles Deregulation Certificate (see Appendix 6) will be issued, with which permanent personnel takes to departments of public security and administration for formalities. Meanwhile, all original bills shall be brought as well and deregulation formalities must be handled by permanent personnel in person.

11. Can all returned overseas students import self-use motor vehicles to China from overseas?

Answer: In most circumstances, overseas students returning to China are not allowed to import self-use motor vehicles from overseas;

Overseas students of high level who are verified by governing departments and live or work back in China for more than 1 year continuously can apply for importing one self-use motor vehicle from overseas (including sedans, SUVs and passenger cars with no more than 9 seats only) by presenting Certificate Overseas Talent of High Level, and customhouse will levy, examine and approve according to regulations.

Overseas students who register in, graduate from and complete courses of standard universities (colleges) abroad , have studied or had further education (including outbound further education and cooperative study) therein for no less than one academic year, and stay abroad for no more than two years after graduation can apply for one purchase of duty-free self-use domestic motor vehicle (manufactured by national designated vehicle manufacturer) within one year since the day they entered China.

12. Is there regulated brand or model for self-use imported motor vehicle to be purchased by foreign permanent personnel? Is brand-new vintage car eligible?

Answer: There is no concept of vintage car in customs categories. The motor vehicle which are eligible to be imported are motorcycles, sedans, SUVs and passenger cars with no more than 9 seats. As a result, vehicles that can fit into the tax regulations of customs are allowed to be imported. In addition, port clearance is required for customs declaration. For details as for whether a certain kind of vehicle is qualified for port clearance issuance, please consult department of commodity inspection.

13. Can self-use second-hand automobile engine rather than commercial use be deemed as baggage and articles accompanying incoming passengers and personal postal articles?

Answer: Baggage and articles accompanying incoming passengers and personal postal articles do not include automobile parts which shall be subject to customs declaration of goods when necessary.

14. Is it permitted for Chinese who have ended a long-term employment abroad to take motorcycles back to China?

Answer: In accordance to relevant regulation, motorcycles are motor vehicles, which are not allowed to accompany incoming ordinary residents. The motorcycle can be freighted back to China only on the condition that formalities of customs declaration are run through according to regulations; old motorcycles are not allowed to be imported under the freight channel. Customs declaration can be entrusted to import and export companies with qualifications; customs duty, value added tax and consumption tax calculated according to gas displacement are levied on motorcycles.

15. Does deregulation of self-use vehicles of embassy staff influence the total number of self-use motor vehicles in the embassy?

Answer: According to Article 29 of Measures of the Customs of the People’s Republic of China for the Supervision of the Entry and Exit of Articles of Foreign Embassies and Embassy Staff in China, foreign embassy and embassy staff in China are entitled to reapply for imported motor vehicles according to the designated total in the following circumstances: (I) Motor vehicles are legally transferred and sold under the regulation of The Method and relevant formalities are done through. (II) Serious damages are caused by accidents or force majeure; use value has completely lost due to usage or service period expiration and the case has been closed. The proposed deregulation formality is not included in Article 29.

16. According to a Chinese friend, the Chinese General Administration of Customs has been canceled the administrative license for us foreigners who bring their own cars into China, is this true?

Answer: We have not received such notice so far. So please refer to the regulations promulgated by the Chinese government and publicized on open channels.

17. is it possible to purchase and import used cars under personal names?

Answer: Firstly please check your own identity; currently ordinary domestic residents can not be brought from abroad cars for private use, still less to say import second-hand cars. Since July 1, 2010, apart from the resident offices and permanent personnel, high-level talents and experts, who, in accordance with the relevant intergovernmental agreements, can import motor vehicles, other permanent institutions and Permanent personnel shall not import the used motor vehicles; and it is also not allowed to import and export used motor vehicles.

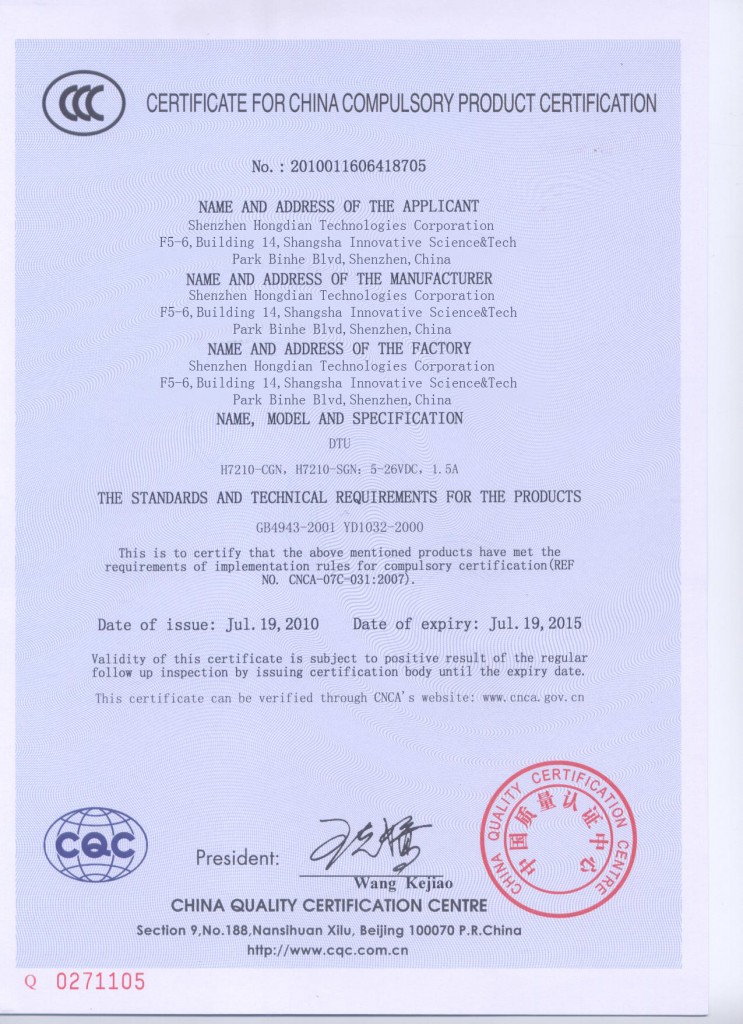

18. Types of Vehicles that can be brought in by foreign businessmen.

Answer: According to what your said, for the 3C certification of imported vehicles, please contact the Entry and Exit Inspection and Quarantine Bureau (Non-Customs Business).

19. Employees in foreign companies from abroad brought back a car in his own name, where should he or she apply? Is this car must be a used one?

In accordance with Measures of the Customs of the People’s Republic of China for the Supervision of the Entry and Exit of Articles for Personal Use of Long-term Non-resident Travelers (Order No. 194 of the General Administration of Customs), if employees would like to bring in cars for their personal use, he or she should submit written application to the local direct custom or subordinate customs authorized by the direct customs. And from July 1, 2010, apart from the resident offices and permanent personnel who, in accordance with the relevant intergovernmental agreements, can import motor vehicles, other permanent institutions and Permanent personnel shall not import the used motor vehicles; application for their used motor vehicles entering the country shall not be accepted by the Custom.

20. Can foreigners who work in China take the car from abroad to China?

Answer: Only Permanent Representative (working in permanent institutions), Only Foreign resident staff enterprises in the three forms of Sino-joint venture, cooperative business and exclusively foreign-owned enterprises in China, and foreign experts can apply for bringing their car into China. But the foreign students studying in China cannot bring in cars for their private use.

21. If Returned overseas students want to buy duty-free vehicle, where can they purchase the vehicle or who can they entrust to complete the purchase?

Answer: in accordance with the Notices form General Administration of Customs for Simplifying and Regulating Formalities concerning Domestic Vehicle Purchase by Overseas Students (SJF [2004] No. 341), the vehicle can only be purchased from the sales departments directly managed by the manufactures (sales department should be a part of the manufacturer) or services sector designated by the General Administration of Customs (CIEETC, Beijing Zhong Qi Zong Diplomacy Scholarly Returnees Car Purchasing Service Co., Ltd.?and CNSC are designated agencies in Beijing).

22. If foreign businessman would like to bring a car into China, how long would the supervision period last?

Answer: If the foreign businessmen obtained long-term residential status in China, long-term residential certificates and complied with permanent staff status the General Administration of Customs Order No. 194, they may apply for the entry of one taxed vehicle for personal use, and since the date of entry and within one year, the vehicle must subject to customs control.

23. How could foreigner entrust others to conduct deregulation procedures of the vehicles brought in by them?

Answer: According to regulations, Permanent staff’s vehicle can be granted for transfer to others only after a year since the time of vehicle registration procedures was completed by the public security traffic management department. For transferring the motor vehicle, permanent personnel shall submit a written application to the competent customs and the original and photocopy of the following documents: (1) Identification; (2) Long – term residence certificates; (3) Motor Vehicle Driving License of the imported Motor Vehicles. (4) Customs Of The People ‘S Republic of China’s Permanent Institutions Record Card of the resident office or foreign-invested enterprises’ Import and Export Goods’ Consignee or Consignor’s Declaration Registration Certificate”, as well as other documents that the customs may consider necessary. As relevant laws and regulations do not specify that the process must be conducted in person, therefore, others can by entrusted to carry out relevant procedures with principal-agent agreement.

24. Question on the types of duty-free vehicles brought back to China by returned embassy staff for personal use

Answer: According to the General Administration of Customs Announcement No. 41 in 2005, the ROC embassy staff in line with the relevant provisions can import duty-free vehicles cars (including off-road vehicles).

25. Recognition of the High-level Personnel Returning from Overseas

Answer: High-level overseas talent and overseas science and technology experts authorized by the Ministry of Personnel, Ministry of Education or the authorized department (specifically, professional and technical personnel of the Ministry of Personnel Management Division , Ministry of Education, international exchanges and cooperation department, personnel and education authorities of all provinces, autonomous regions and municipalities directly under the Central People’s Government) can be collectively referred to as the high-level personnel . High-level overseas talents who return home to live or work for more than one year, they can import a self-use of motor vehicles (9 seats and below).

26. For personnel with foreign expert working documents who hold foreign permanent residence green card but Chinese passport, and are to be sent back to Chinese branch, can they take vehicle back to China for personal use?

Answer: (1) Permanent staff among long – term non-resident visitors can import the car, the identity requirement of the permanent personnel are as follows: The resident staff among the non-resident travelers refers to the staff working at overseas enterprises, news organizations, trade organizations, cultural groups and other permanent institutions established within the territory of China and recorded in the Customs, Or personnel within of foreign-invested enterprises registered in Customs Office, or foreign experts who work long-term in China. (2) According to your description, if the personnel hold both the Foreign Expert Certificate of the People’s Republic of China and the Domestic long-term residence certificates, they can import vehicles to China for personal use.

27. Question on Import ports of the vehicle brought in China by individuals for personal use

Answer: The country designated four coastal ports in Dalian Port, Tianjin Xingang , Shanghai , Huangpu Port and Manchuria , Shenzhen (Huanggang ) two land crossings for vehicle import port . Please contact the local Customs for examination and approval procedures.

28. Conditions for overseas students’ purchasing of duty-free vehicle

Answer: regulations of customs on overseas students’ duty-free vehicle purchase are as follows: Overseas students who have registered in standard universities (colleges) abroad, have studied or had further education (including outbound further education and cooperative study) therein for no less than one academic year and have returned back to China for work within one year of graduation can, upon approval of customhouse, apply for one self-use duty-free domestic motor vehicle within the duty-free quota with the following certificates presented: valid passport and Overseas Student Certificate issued by Chinese embassies in foreign countries or Certificate of Study in Hong Kong or Macao issued by central government office in Hong Kong (Macao); Residence Permit in China issued by Public Security Bureau; other documents required by customs of records place (places where returned overseas students live or work). Returned overseas students shall submit application of duty-free domestic motor vehicles purchase to customhouse within six months since the return and the customs has the right to reject the overdue application.

29. How long is the supervision period of diplomatic personnel’ self-provided motor vehicles and what are the documents required for deregulation?

Answer: In accordance with No. 41 Notice of 2005 of General Administration of Customs, duty-free self-use motor vehicle accompanying embassy staff to return is subject to customs supervision and the period is six years from the customs release. Within the regulation, motor vehicle of embassy staff shall not be transferred, sold, etc. When transferring, selling or disposing are necessary for embassy staff, customs declaration shall be submitted in writing to governing customhouse for approval with personal ID card and Vehicle License presented. Upon governing customhouse’s inspection and after the duty short-paid is paid, the People’s Republic of China Customs Control Vehicles Deregulation Certificate will be issued, which embassy staff shall take to departments of public security and administration for relevant procedures.

30. Questions concerning exchange rate of imported vehicle brought back to China by embassy staff?

Answer: Where price and relevant fees of imported and exported goods are valuated in foreign currency, the customhouse will convert the number into paid value in RMB according to the tax rate applicable to the goods as well as to taxable exchange rate in that day. The paid value will be round off to Cent. The taxable exchange rate adopted every month is the basic rate of foreign currency to Renminbi announced by People’s Bank of China on the third Wednesday (where the third Wednesday is legal holiday, the fourth Wednesday will be taken) of last month; where price and relevant fees of imported and exported goods are valuate in foreign currency that is not included in basic rate, the median of buying rate and selling rate announced by Bank of China will be adopted (decimal of 4 digits after rounding off in RMB/Yuan) . Where the aforementioned exchange rate seriously vibrates, other taxable exchange rate can be regulated and announced to public when necessary.

Please refer to Rules of the Customs of the People’s Republic of China for the Administration of the Levying of Duties on Imported and Exported Goods (Notice No. 124 issued by General Administration of Customs)

31. Questions concerning reapplying after transferring accompanying vehicles.

Answer: In accordance with Article 2 of Chapter 1 in Notice No. 194 of Administration of Customs, “Long-term non-citizen passengers’ accompanying self-use articles shall be of personal use with reasonable quantity; permanent personnel can apply for one incoming motor vehicle accompanying passenger and long-term non-citizen passengers are not entitled with incoming motor vehicle.” As a result, you have applied for one incoming motor vehicle before and are not entitle to applying again.

32. Questions concerning Foreign (Finnish) people’s Importing of Kart

Answer: In accordance with the customs regulations, no foreigner is allowed to import kart for personal use.

33. After the approval of the competent customs, how can the overseas students handle the car procedures?

Answer: Under current rules, after going through domestic duty-free vehicle purchasing examination and approval procedures in local customs, overseas students, or others or three agencies approved agencies(CIEETC, Beijing Zhong Qi Zong Diplomacy Scholarly Returnees Car Purchasing Service Co., Ltd.?and CNSC )commissioned by the students shall complete procedures at the vehicle manufacturers’ local customs with the custom seals. And the process goes as follows: the student shall provide passport and customs seal, if it is entrusted to the others, the student need to sign the power of attorney for local customs’ signature confirmation, then the delegate shall Filing procedures in Shanghai Customs with the original and copy of customs seal, power of attorney, and their own identity documents, etc. after completing this procedure, the car can be purchased from the manufacturer.

34. ever since July 1. 2010, what are the requirements for the permanent personnel to import vehicles?

Answer: Permanent staff can apply for entry of a motor vehicle, limited to one per person. According to Notice No. 32 of 2010, from July 1, 2010, apart from the resident offices and permanent personnel who, in accordance with the relevant intergovernmental agreements, can import motor vehicles, other permanent institutions and Permanent personnel shall not import the used motor vehicles; application for their used motor vehicles entering the country shall not be accepted by the Custom. But application to the customs filed before July, 1, 2010 for the entry of a motor vehicle in accordance with the relevant provisions shall not be subjected to this restriction.

35. Whether the dependant of the overseas embassy staff can bring in duty-free vehicle for private use?

Answer: According to the General Administration of Customs Announcement No. 41 of 2005, only the permanent staff of China’s embassies and consulates abroad can bring their vehicles back on returning to China for personal use. Their members of the family can not bring in duty-free vehicle for private use.

36. Questions concerning Chinese nationality international staff serving in the United Nations system (ie the secondment of staff) on bringing the car for private use.

Answer: According to the General Administration of Customs Announcement No. 41 of 2005, only the permanent staff of China’s embassies and consulates abroad can bring their vehicles back on returning to China for personal use. Those Chinese nationality international staffs serving in the United Nations system do not fall into this category; therefore, they cannot bring back their car for private use.